The focus this month is on GRESB, once again. The countdown to the opening of the GRESB Portal on the 1st of April is well and truly underway. For those of you who do not yet know, GRESB is an organisation founded by investors recognising the need to set standards on behaviours and practices in the real estate space, consequently making real estate investments compliant with desirable attributes falling under the ESG umbrella.

What exactly is ESG?

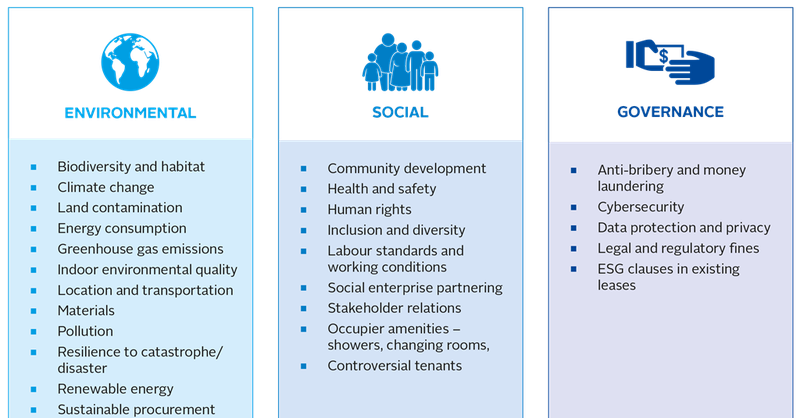

ESG is an acronym for Environmental Social and Governance and is an umbrella term for key areas of

sustainability and ethical practices of businesses. It covers a broad set of practices including company strategy, leadership & management style, stakeholder engagement policies and energy conservation practices, to name a few. The table below lists and categorises some of these practices under the environmental, social or governance headers and by no means is this representative of an exhaustive list, and here lies part of the problem. If you are not familiar with the term ESG, it can seem somewhat nebulous; the significance of ESG categories vary from industry to industry; more so, the difficulty lies in recognising those categories that are relevant and pose material financial risk to organisational objectives and assessing them in terms of likelihood, magnitude and impact.

Why is ESG important

Looking through the table, some of the practices listed under the social and governance categories are good practices that most organisations should follow. For instance, the contribution of gender and diversity to the workplace is well documented and recognised for its contribution to a more productive workplace, while raising workforce awareness in anti-bribery and anti-corruption can prevent misappropriation of funds. But I feel that these so-called behaviours and practices are mostly specific to a particular sector.

Who does ESG matter to?

Primarily, within the context of GRESB these are large institutional investors, who manage large funds and invest in real estate, either by purchasing physical assets but more commonly by purchasing shares in real estate companies. ESG reporting helps investors assess the fitness of companies in the real estate space. In light of the ever evolving regulation, evaluating real estate ESG risk and exposure alongside the more traditional methods of real estate valuation is fast becoming the norm. Investors have come to rely on GRESB, the preeminent real estate rating agency to report on the relative ESG ratings of real estate companies.

How does GRESB measure ESG

What GRESB has managed to do is to create a framework of measurement around these desirable and sought-after qualities. The framework is designed to identify and disclose those factors impacting real estate assets - factors which may also have a material effect on investment. The framework itself is divided into three components:

Management - measures the entity’s strategy and leadership management, policies and processes, risk management and stakeholder engagement approach, comprising of information collected at the organisational level.

Performance - measures the entity’s asset portfolio performance, comprising of information collected at the asset and at the portfolio level. It is suitable for any real estate company or fund with operational assets. The Component includes information on performance indicators, such as energy consumption, GHG emissions, water consumption and waste

Development - measures the entity’s efforts to address ESG issues during the design, construction, and renovation of buildings. This Component is suitable for entities involved in new construction (building design, site selection and/or construction) and/or major renovation projects, with on-going projects or completed projects during the reporting period

There was a refactoring of the framework in 2020, which consolidated the previous seven components down to three - , as well as creating a clearer distinction between standing investments which are scored using the Management and Performance components only, and New Construction projects, scored using the Management and Development components only.

In comparison to other components, Performance, pertinent to standing investments, is more quantitative in nature and requires participants to collect energy, GHG, water and waste data at the asset level. Significantly, asset level data is no longer optional, and without the correct tools, this may increase the administrative burden, especially for organisations with a large portfolio of assets. The survey still makes heavy use of the questionnaire format which lends itself to mainly qualitative data. The beauty of GRESB is in how it enumerates responses into a final ESG score that can be used by the investor community.