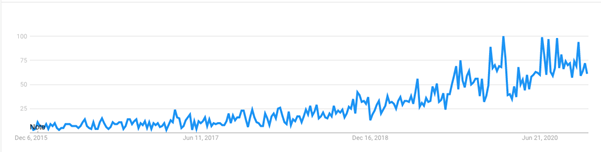

The interest in ESG (Environmental, Social and Governance) investing has really accelerated in the last few years — this Google Trends graph shows that quite clearly:

Environmental, Social and Governance criteria are used by socially conscious investors to assess the value of potential investments, in terms that go beyond financial gains. In the Commercial Real Estate industry (CRE), this might mean choosing to invest in a portfolio of highly energy-efficient buildings, or in infrastructure that brings social benefits, such as regeneration projects, and healthcare or community buildings.

But what proportion of global real estate investors and fund and asset managers are bringing ESG criteria into their decision-making? And what, if any, measurable value does this add to their portfolios? In this blog, we’re going to look at the business case for investing in environmentally sustainable CRE in particular.

Growing pressure for environmentally sustainable buildings

It’s no secret that the property sector is a major contributor to greenhouse gas emissions. It creates approximately one-third of global greenhouse gas emissions, and 40% of global energy consumption. In order to meet the commitments made in the Paris Climate Agreement, the global average building energy intensity per unit of floor area needs to be at least 30% lower in 2030 than its current levels (source: UNEP Finance Initiative’s Global ESG Real Estate Investment Survey Results, 2019).

Exacerbating that challenge, is the expectation that global building floor area will double by 2050, increasing energy demand and related GHG emissions for construction (source: UNEP Finance Initiative website).

In response to this urgent need to turn the tide on building-related GHG emissions and energy consumption, legislation around energy efficiency and ESG has been tightening. For instance:

- the 2018 Minimum Energy Efficiency Standards (MEES) for commercial premises in the UK, and its looming 2023 deadline

- the forthcoming EU Taxonomy Regulations, which define six clear environmental objectives and place an obligation on certain companies to disclose how much of their investment meets these objectives

- the SFDR regulations, which will come into force from March 2021, and will require much greater transparency from both asset managers and investment firms that manage ESG products.

In addition to legislation, there’s an ever-expanding list of countries and cities that are pledging to be Net Zero Carbon by 2050 or sooner. This is adding to the pressure on the CRE industry to become ‘greener’ faster. For instance, 28 cities have now signed up to the World Green Building Council’s Net Zero Carbon Buildings Commitment.

The risks of climate change to CRE investors are becoming more tangible too. There is strong evidence that wildfires, storms, floods and droughts are becoming more frequent as a result of climate change. A recent report by the American finance company, MSCI — ‘2020 ESG Trends to Watch’ — found that 68% of the total capital value of U.S. properties in the MSCI Global Annual Property Index, was exposed to at least one of three climate hazards: hurricanes, wildfire or water stress.

How is the CRE industry responding?

Probably the best measure we have of this is the Global ESG Real Estate Investment Survey Results, 2019, which surveyed global real estate investors, and fund and asset managers operating in three regions (Asia-Pacific, North America and Europe) between September 2018 to February 2019. Those surveyed represented more than $1 trillion USD of assets under management.

The key findings from this survey were that:

- 93% include ESG criteria in investment decisions

- 90% plan to further analyse ESG criteria over the next 12 months

- 85% are highly or very highly motivated to use ESG criteria to lower risk, and

- 83% have experienced an increase in investor demand for sustainability disclosure.

In addition, the survey found that the respondents’ top five ESG targets were all environmental concerns: GHG reduction (59%), energy reduction (47%), waste reduction (35%), water reduction (35%) and green building certifications (24%). 91% of respondents said they were using sustainability disclosure frameworks; the most favoured being GRESB.

These results are very positive, showing a global trend towards ESG adoption in the real estate industry. More recent data indicates that the Covid pandemic hasn’t slowed this trend; if anything, it’s accelerated it. Sustainable funds were up 72% in the second quarter of 2020, bringing the total value of assets in ESG-focused funds to around $1.1 trillion — more than double 2016 levels (source: INDOS Financial website). This could be due to the realisation, post Covid, that there is a link between health and climate change and that institutions need to be better prepared to mitigate the risks of future crises.

The value of environmentally sustainable buildings to investors

Asset managers and investors are beginning to see how portfolios that include more environmentally sustainable buildings can reduce their risk exposure, and deliver greater value in the medium-term.

Buildings that have poor sustainability credentials, such as those with poor energy efficiency ratings or those at risk from flooding, have a number of risks associated with them, as the Global ESG Real Estate Investment Survey Results report outlines:

- Physical risk — The physical impacts of climate change, such as extreme weather, can lead to higher insurance premiums, higher capital expenditure and operational costs, and a decrease in the liquidity and value of buildings. For instance, one research study found that real estate properties in the US that are exposed to sea-level rise are currently selling at a 7% discount compared to similar properties with less exposure (source: The Rise of ESG in Real Estate — Center for Applied Research). And another report by the Urban Land Institute and Heitman LLC points to evidence from a study by the Royal Institution of Chartered Surveyors (RICS), which showed a potential catastrophic rise in energy bills by 2050, if commercial buildings in eight European countries were not retrofitted to address climate risks.

- Regulatory risk — As regulations are tightened, there’s a higher risk of penalties being imposed for energy-inefficient buildings and those with high GHG emissions. The EU’s Carbon Risk Real Estate Monitor (CRREM) has been created as a response to this threat. It’s a useful tool for assessing the risks of a building becoming prematurely obsolete, ‘stranded’, or written-down because of changing market expectations and legal regulations around GHG emissions. It also offers ‘decarbonisation pathways’ to reduce these risks.

- Economic risk — There is growing evidence that buildings with strong sustainability credentials, such as those with green building certifications, can reduce economic risks for investors. The Global ESG Real Estate Investment Survey Results point to a 2019 study in North America, which showed certified buildings had a higher probability of lease renewal, offered lower incentives, and had more satisfied tenants. The research also found that certain certifications led to a small rent premium and had a lower vacancy risk.

Similarly, MSCI’s 2020 report cites their own analysis of Australian office properties. They found that high-rated properties (a 4-to-6-star National Australian Built Environment Rating System, or NABERS rating) had cumulative income returns over the past five years that were 40 to 60 bps higher, on average, than the low-rated properties. This differential prevailed across market segments. Interestingly, the NABERS star system cited here, which rates the energy efficiency of office buildings, has recently been introduced to the UK.

In short, there are increasing risks associated with buildings that aren’t environmentally sustainable which threaten the value of that property, and some early indications of ‘green certified’ buildings being more attractive to tenants, and commanding higher rents. With the journey to Net Zero Carbon now gaining momentum and a change in the American presidency, it’s hard to see this trend slowing down any time soon.

So how do you build a more environmentally sustainable CRE portfolio?

If you are investing in new builds, you need to first address the amount of carbon emissions associated with the construction phase. This ‘embodied carbon’ as it’s known, can amount to 20-50% of the whole-life carbon emissions of a building (source: Circular Ecology).

Moving beyond the construction phase, you’ll need to invest in digital solutions that can monitor and optimise the performance of all the buildings in your portfolio. An obvious starting point is to ensure that a good energy data management system is in place for all the buildings in your portfolio, so you can measure just how environmentally sustainable they are. You need accurate, regular data for metrics such as energy and water consumption, waste levels, as well as operational data and other variables (e.g. degree days, occupancy, temperature). This enables your property managers and sustainability experts to understand which variables influence energy consumption and carbon emissions the most, so they can see where improvements could be made.

Once you have the right meters, sensors and data monitoring set up for your buildings, it’s important to benchmark your performance against similar portfolios, and set environmental goals and objectives. A number of public benchmarking frameworks have been created to make it easier for CRE asset owners and managers to measure and report on their portfolio’s sustainability credentials, including GRESB, the Real Estate Environmental Benchmark (REEB), and CIBSE’s Energy Benchmarks. The Fabriq energy data management platform makes it easy for you to compare your portfolio against these industry benchmarks and speeds up the GRESB annual reporting process.

More about the Fabriq platform

Find out more about how the Fabriq energy data management platform can benefit you and follow the links to download the brochure about GRESB reporting.

Find out more in our webinar

These are just the initial starting points; we went on to cover how to build a more environmentally sustainable CRE portfolio in greater depth in our webinar: Building an environmentally sustainable CRE portfolio. Hosted by Fabriq’s Colin Ma and guest speaker Howard Pierce, a partner of a Spanish asset manager group, Urban Input. Watch now!