Is there any evidence of a discernible financial advantage for achieving an improved GRESB rating, e.g do capital values of high scoring assets increase?

Following our recent GRESB webinar, GRESB, how to measure what matters, a few interesting and challenging questions were posed by the audience. Admittedly, I felt that I failed to answer these questions in their entirety. I mean, how could I. In general like to respond with evidence backed answers. One intriguing and cheeky question was is there evidence of a discernible financial advantage for achieving an improved GRESB rating. So after the webinar, I was set to task to produce a better explanation.

Speaking of the financial advantage of achieving an improved GRESB score, one should consider this in the context of the reason behind becoming a GRESB member and also how that GRESB score is used by investors....read on.

Organisations become GRESB members with a purpose of ESG disclosure to institutional investors. Remember, these are big league investors with huge pots of money or funds, looking for top grade investments. ESG disclosure through GRESB comes with an implicit obligation to comply with the framework criteria, which extends beyond a box-ticking exercise to evidence-based operational and performance improvements and strategic ESG alignment of business practices.

One could reasonably argue that the primary concern of an investor is maximising his/her return while either minimising the risk or at the very least understanding the risks, to protect or hedge against losses. ESG risks are a relatively new concept as far as risk is concerned and as a contemporary issue it is all everyone is talking about, i.e. ESG sentimentality is at an all time high and there is an abundance of internet articles showing the explosion of ESG over the past couple of years. However, ESG is more than just a fad, the prescription for industries and business sectors to comply comes from established directives a la the United Nations Sustainable Development Goals and the Paris Climate Agreement.

Typically, an investor managing one or more ESG funds is obliged to disclose details of ESG compliance to prevent ‘greenwashing’ - the act of disinformation so as to present an environmentally responsible public image - therefore any potential investments must meet the standards that are being claimed. An investor can therefore use the GRESB scores as an indicative tool to screen out low scoring ESG performers or to engage with companies that are part of their existing investments, who might be underperforming according to ESG criteria.

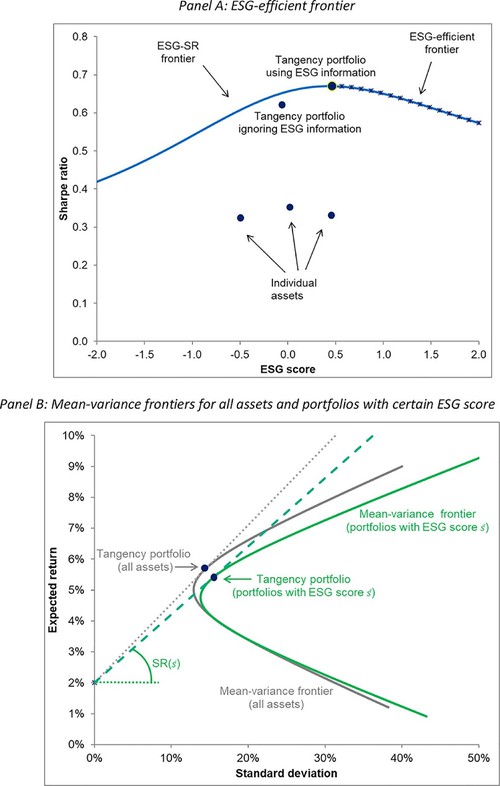

One interesting study called Responsible Investing: The ESG-efficient frontier by Pedersen, Fitzgibbons and Pormorski in The Journal of Financial Economics

shows the implementation of ESG screening. In this study ESG scores are informational (e.g. The GRESB score provides information to investors) and preferential (e.g. an investor will choose the portfolios meeting their ESG criteria). In the study the ESG of a portfolio of assets is measured against a risk-adjusted return statistic called the sharpe-ratio. This is shown in Panel A.

By plotting the sharp ratio against the ESG scores, an ESG efficiency frontier is formed (i.e. a line representing those portfolio of assets where the risk-adjusted return is maximised for any given ESG score). Any point lying below this line is an inefficient investment and therefore screened out. On the ESG-efficient frontier, the investor will choose portfolios based on their ESG preference.

My explanation does not do justice to the study because it is extensive - the extent of the study is beyond the scope of this humble blog - but if you are interested, the study can be found via the link provided, above. Further details on screening can also be found on the PRI (Principles for Responsible Investment) website.

In conclusion, I see an ESG score as a level of fitness and please forgive this, somewhat, esoteric comparison but it reminds me a little of how springbok gazelle leap into the air to demonstrate their level of fitness, as a survival mechanism (stay with me here). Far from being chased and eaten by cheetahs, real estate owners are demonstrating that they are worthy of investors’ attention and money. By achieving the highest ESG score possible CRE owners show fitness relative to their peers and achieve the financial advantage of being considered a worthy investment target.