3 Factors Driving Building Optimisation that CRE Should Reconsider

There is very little doubt surrounding the fundamental role that energy efficiency plays in the success of commercial real estate making a return once the world reaches somewhere close to normal. Whether you refer to it as sustainability, energy efficiency or building optimisation, the need for us all to ‘run buildings better’ is increasing exponentially.

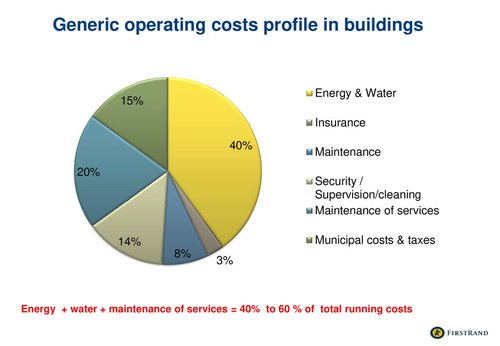

There will be an understandable emphasis placed on healthy workplaces in the coming months but that can’t be at the expense of a building's buildings carbon footprint. Equally, businesses must do what they can to minimise excessive operational costs after months with little, or no revenue. With running costs associated with electricity, gas and water constituting up to 50% of a commercial building operating costs, efficiency measures are a viable cost-saving measure, but this can’t be at the expense of occupant well being. You see where I’m going with this…

The three underlying driving factors of building optimisation are:

Operating Costs

Buildings are expensive to run. Electricity and gas prices have taken a dip over the last couple of months but are sure to climb higher than ever before in the not so distant future. A key driver for energy efficiency in buildings is the benefit it can have on bottom-line costs of a business. There aren’t many investments opportunities that have as much certainty as energy-efficient or low carbon technology, particularly those that are tried and tested.

During the design and planning phase of the build, energy-efficient technology is often left out of the final specification to reduce the overall costs. However, what developer fail to understand, is that by avoiding a short term cost they will endure much higher operating costs due to energy usage, and equipment life cycles will be reduced when major plant is running longer than necessary. Additionally, retrofitting energy-efficient technology is far more expensive post-construction than during design and build.

Even state of the art new-builds with smart building and IoT technology can be incredibly expensive to run if not managed properly. I’ve often found that during a rushed hand over from developer to operator, building services are set to fixed speed instead of demand-based control. This results in a building that fails to respond to it’s internal and external environment and is inevitably costly to run.

Occupant Wellbeing

The importance of employee or occupant well being has been rising steadily over the last few decades. In a post-COVID world, it has skyrocketed. It’s no longer just a case of providing a ‘comfortable’ space to work but a healthy one as well. Standards such as RESET and WELL will no doubt increase in popularity and could become a must-have for building operators.

With the recent epidemic in mind, the most important metric to monitor closely will be CO2 parts per million and relative humidity. In commercial office buildings such as offices, CO2 ppm should not exceed 1,000. Exceeding this threshold could result in complaints of headaches and drowsiness but more importantly, indicates that the rate of air changes is too low which will increase the risk of diseases spreading. Relative humidity should be maintained between 40% and 60%. Dry air (below 40%) makes it easier for airborne viral particles to travel.

Environmental Impact

It’s a well-known fact that buildings account for around 40% of the world energy use. Buildings becoming more technologically advanced doesn’t always mean they are more efficient. More and more commercial buildings are using air conditioning through the summer in temperate climates like ours in the United Kingdom.

If there is one positive thing to come out of this crisis it’s that world leaders have surely realised that the human race and the world we live in, is far from indestructible. The objective of Net Zero Carbon by 2050 is becoming increasingly unlikely in the absence of a major technological breakthrough.

The emergence of ESG (Environmental, Social and Governance) has raised the profile of sustainable buildings over the last decade or so. The basis of ESG is founded on the assumption that it’s three components have financial relevancy when it comes to investing in property. Standards such as GRESB (Global Real Estate Sustainability Benchmark - read more on GRESB here) are providing further incentives to optimise building performance to better the environment.

Finding the balance

Although operating costs, occupant wellbeing and environmental impact might seem like independent variables, in reality, they are intrinsically linked. In almost all situations one will affect the other two. It’s rare to find businesses that consider all three, typically they are driven by one of two with the other being an afterthought. This has disastrous consequences.

A business that introduces a measure to reduce its operating costs must consider the impact it will have on its occupants and the environment. E.g Reducing the need to heat/cool air by increasing the rate of recirculation will reduce air quality. Installing a CHP (Combined heat and power) unit will reduce energy costs but increase reliance on fossil fuels.

A business that wants to improve the level of comfort and well being of its occupants must consider the risk of increases operational costs and the impact on the environment. E.g By bringing in more fresh air from outside you will likely increase the need for heating and cooling which will increase the overall energy costs and carbon footprint of the building.

A business looking to improve its ESG performance ( read here about post-Covid 19 ESG reality check), should consider how this will affect operating costs and occupancy wellbeing. E.g Almost all efforts to improve buildings carbon footprint will come with a considerable cost. It’s essential to consider the most financially viable options with the best return on investment. Short terms financial performance is more important than ever during these uncertain times.

Let's grab a coffee and discuss how we can make a buildings great again!