Commercial Real Estate Post-Covid-19 Reality Check, on Environmental And Social Governance

Prior to the COVID-19 outbreak, ESG topics were steadily making their way to the top of forward-thinking stakeholders’ agendas in commercial real estate. With the impact of the COVID-19 outbreak being felt across the sector and the world today, different views on how ESG performance would be prioritised in commercial real estate going forward in the immediate and the longer term are emerging. We thought this would be a good opportunity to share what we have been learning on the ground regarding ESG topics before and after the arrival of the COVID-19 outbreak, especially from our experience working and exchanging ideas with our partners and customers who are ESG practitioners in the field.

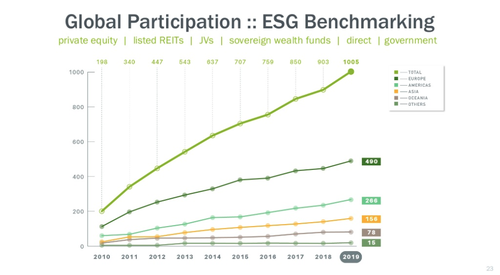

Before the COVID-19 pandemic brought the world to a grinding halt, investors, regulators, industry bodies, property owners, managing agents, as well as tenants, were coming around to the hypothesis that better ESG performance translates into higher asset value in the commercial real estate space. It is of no coincidence that programmes like the Global Real Estate Sustainability Benchmark (GRESB) or the Real Estate Environmental Benchmark (REEB) have been becoming increasingly relevant and that more ESG and sustainability professionals have been entering the commercial real estate space.

From conversations with partners and customers, we were sensing a clear uptick in interest in factors that drive environmental performance (or the ‘E’ in ESG) in particular. Looking back at the initial ESG reporting requirements that the end users of our platform had, (during the EnergyDeck days!), it was acceptable to only go as far as being able to report roughly how much energy a building consumed; or what was a portfolio’s overall carbon footprint (perhaps only using estimated figures from the landlord’s utility bills) during a given year. Fast-forward a few years, most end users of our platform - now known as Fabriq OS - today expect systems to support both the reporting and the monitoring of environmental performance of buildings at the asset and the portfolio level using a variety of metrics (e.g. waste generated, energy from renewable sources, etc.) in more precise and comprehensive terms (have a look at this blog post on the latest platform capabilities in GRESB reporting). We also noticed increased interest in implementing Fabriq OS platform to account for some of the ‘S’ (social) factors, specifically in the commercial real estate space. Overall, the trend was that ESG performance was becoming more significant and relevant in CRE and that it would likely only become more so going forward.

Then, of course, came COVID-19. There are opinions, that the pandemic would prompt ESG to take a backseat, at least on a temporary basis, in commercial real estate. It is easy to see why, especially for those in the sector, who are finding themselves in survival mode because of the pandemic and as the uncertainty continues, shops, restaurants, and other spaces shuttered indefinitely. Some are going a step further and are predicting that the ‘E’ in ESG would be de-emphasised in particular. The pandemic is being seen by some, as a major blow against the climate crisis and other environmental issues agenda, which was gaining significant traction in most parts of the world in 2019, and was continuing to do so with many companies racing to declare their net-zero-carbon ambitions right up until the outbreak evolved into a global crisis. Considering the catastrophic and immediate impact that the pandemic has been causing, it is not difficult to understand why some would hold these views.

However, encouragingly, many are also holding a different view on how COVID-19 would affect the relevancy and significance of ESG performance in commercial real estate. In fact, many are seeing strong ESG credentials as more of a ‘must have’ than a ‘nice to have’ going forward, with those inclined to deliver higher ESG performance seen as ones that would hold a significant competitive advantage in an industry and a world that have been exposed to COVID-19. In particular, many of the ‘S’ topics – such as those pertaining to the health and well being of occupiers of buildings – have become increasingly relevant as a result. For example, we have been receiving an increasing number of inquiries regarding solutions for monitoring indoor environmental conditions (e.g. air quality), HVAC systems, and occupancy levels of spaces. These topics, and ways to assure the safety of those, who will once again occupy spaces vacated because of the COVID-19 outbreak, will only become more relevant, as shops, restaurants, offices, and other venues begin to reopen for tenants and visitors. We already know that new regulations will be introduced to ensure public safety, particularly within non-domestic enclosed spaces. This could very well mean, that those who already see ESG performance as a priority would be ones, who would be the most prepared to navigate a landscape with more compliance requirements.

There are also those who see the COVID-19 outbreak as a stark reminder that the world must act immediately to mitigate against other so-called ‘invisible’ risks, which we have been warned to address urgently, but have been ignoring. Perhaps this is the much needed wake-up call, to start responding to the climate crisis with a much greater sense of purpose. And if this is indeed that wake-up call, with many believing that the losses resulting from unmitigated risks associated with the climate crisis would be far greater than those associated with a global pandemic, a strong case can be made that assets with robust environmental (as well as other ESG) credentials, are those that will stand the test of time and offer the most value. And lastly, I feel strongly encouraged by the fact that in the midst of the COVID-19 crisis, we are continuing to respond to requests for ESG solutions and are still due to launch new projects for clients who are choosing to remain bullish on Environmental and Social Governance.

Overall, at Fabriq, as we continue to monitor how the pandemic evolves and witness the catastrophic effects that could result when a significant but seemingly ‘invisible’ risk is left unchecked, we also remain optimistic in thinking that we as a society are capable of not only recovering from this crisis, but also evolving for the better from it as well.

If you would like to know more about the future of ESG , let's grab coffee and begin the conversation.