If anyone was to tell me 3 weeks ago that the whole of world of work and play would be turned upside down due to an unseen global enemy, I would have strongly recommended they watched better sci-fi movies. Even by my film standards, that scenario made for a very unlikely narrative. Looking at the world now, the reality seems to beat the script. This Coronavirus crisis has hit all sectors of the economy - locally, regionally, globally - and impacted all of our lives in an unprecedented way.

As a technology company, aiming to significantly reduce climate change by connecting and optimising the world’s buildings, I have tried to look at some positive aspects on how this crisis is impacting PropTech and the real estate sector at large:

1 – The release of new-to-market products will get postponed.

Which means there is a huge opportunity for disruptive companies to continue the work on their product-market fit with less pressure to deliver against tight deadlines from the outside world. As such, I expect to see less ‘minimal viable product’ and more ‘market viable product’ iterations coming out this year.

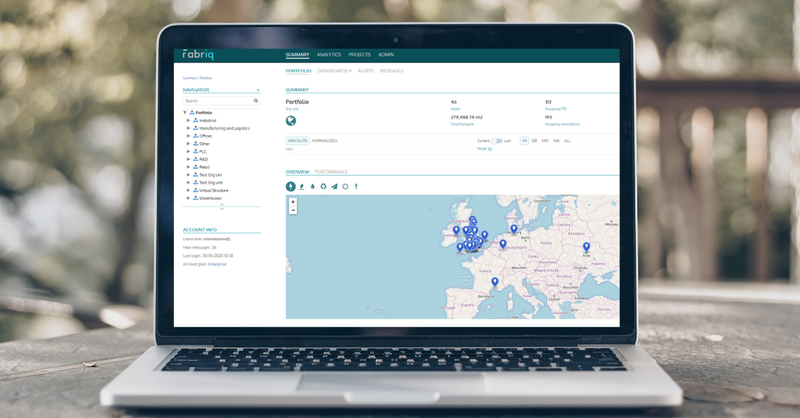

While for more established companies, this is a chance to increase their foothold, to demonstrate how their product capabilities deliver value, in exceptionally testing times, and get closer to achieving their founding vision. So, those PropTech platforms helping clients embrace new, future-proofed ways for energy saving and resource management are likely to thrive thanks to increased product adoption.

2 - This time is a catalyst for leveraging digital-first facilities management.

With everyone working from home and not going into offices anymore, the commercial real estate sector is radically forced to shift towards Cloud based solutions and other remote tools. In these new circumstances, open source technologies offering transparency and ease of collaboration will convince traditional prospects to come on board, prospects who would have previously resisted such digital solutions.

It is also an opportunity for PropTech innovation to focus on the 'forgotten' demographic e.g. non tech savvy audience and deliver an intuitive coherent user experience.

3 - Dried up investment? Don’t be so quick.

B2B SaaS will show resilience as the global economy shifts because it relies on a recurring revenue model (vs one-off sales deals). Growth may slow down, but for mission-critical platforms, churn is unlikely to be destabilising and, hopefully, unicorns can still emerge.

Moreover, for investors, some PropTech products offer alternative investment vehicles that are not as subject to volatility as traditional market-based ones. For example, token based PropTech open up comparatively stable property investments, while still providing easier liquidity than that space would otherwise provide. It is also the time for investors to go back to solid business fundamentals, including appreciation for the 'A' teams not just the 'A' products. It is not just about showing product leadership but also demonstrating resilience and ability to pivot strategically and strengthen ecosystem bonds.

As for us, we are actively engaged with our partners in finding novel ways to deploy our technological innovations to identify spare capacity within the real estate sector.

I am keen to know your thoughts on this, so please get in touch and remember, there are no right or wrong answers.